The European Union’s three victims-so-far of the global financial meltdown have, not incorrectly, been described as the economic bloc’s periphery. Their economies are relatively small and, though at times worries about their debts have undermined the euro currency, their problems – even taken in combination – are hardly likely to bring the bloc to its knees. Individually, they were sick from a debilitating cocktail of similar problems: bed-ridden with debt and weak from a bad diet of profligate government spending and loan-happy banks. Nothing, it seemed, that a dose of bailout money from the EU and IMF could not cure with a trip to the emergency ward. Spain is showing similar symptoms. … [Read more...] about Spain: Too big to fail?

pigs

Portugal’s debt: a tale of pride and prejudice

Borrowing costs on Portugal’s debt have hit a level that proved unsustainable for both Greece and Ireland, but Lisbon is refusing to countenance talk of an EU bailout. Can this small, recession-prone nation hold out much longer? Long lumped along with Ireland, Greece and Spain as one of the so-called PIGS, Portugal has so far managed to face down fears about its ability to service its debt better than many policymakers, economists and investors could have expected. Even as the yield on 10-year Portuguese bonds soared to 7.63 percent in mid-February –the highest level since the country became a founder member of the single currency at the end of the 1990s– and the European Central … [Read more...] about Portugal’s debt: a tale of pride and prejudice

Spain’s sovereign debt crisis: Round 2

It may look like a replay of last May and June, soaring bond yields and all, but there are some important differences between the current bout of financial market distemper and that of the spring. At face value, it is somewhat worse. The interest rate demanded of the Spanish 10-year bond is about 20 points higher than it was at its most back then, and the risk premium embodied in the difference between the yield on the German bund and the former is 40 basis points greater – in fact at a euro-era maximum. But looking a bit beyond the immediate it is interesting to note that all this activity has not cut into euro exchange rates remotely as much as it did in the spring, that the price of … [Read more...] about Spain’s sovereign debt crisis: Round 2

Not yet a Greek tragedy, but still a Spanish drama

“Complete insanity” is how Prime Minister José Luis Rodríguez Zapatero summed up speculation that his government had approached the International Monetary Fund to request a €280-billion bailout. “These rumours can increase differences and hurt the interests of our country, which is simply intolerable and of course we intend to fight it,” he told reporters in Brussels ahead of an emergency summit among leaders of countries using the euro currency. The IMF also denied the speculation. The rumours that Spain was looking for help started circulating after the European Union and the IMF agreed on Sunday to the first bailout of a euro-zone country, giving Greece a €110-billion loan over … [Read more...] about Not yet a Greek tragedy, but still a Spanish drama

What now for the “PIGS”?

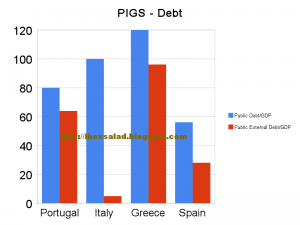

Spanish savings bank La Caixa recently brought to market a €1-billion issue of three-year cédulas territoriales at 70 basis points over similar sovereign debt. As for the investors – 49 percent of these securities backed by loans to Spanish public administrations were picked up by German or British parties and 36 percent by locals. Given the horrific recent treatment of Greek debt, this benign event probably invites a closer look at the tenets behind the classification of a nation as one of the “PIGS” - as if the mere fact that Spanish sovereign 10-years are yielding approximately the same as when the crisis broke last December, whilst the Italian equivalent pays investors 10 basis points … [Read more...] about What now for the “PIGS”?

Running on Ẽmpty

A year after Spain’s centre-left government officially launched a massive stimulus package known as the Plan Ẽ, workers are still losing their jobs, public debt levels are scaring markets, and the economy is not likely to emerge from recession until 2011 at the earliest. Plan Ẽ, with its billions for public works projects, tax breaks and subsidies, was never intended to be more than a temporary bandage to get Spain through the worst of the fallout from the international financial crisis and the collapse of the domestic real estate and construction sector. But the wounds inflicted on Spain’s once booming economy have turned out to be slow to heal, and tearing the plaster off - as, for … [Read more...] about Running on Ẽmpty