Good news from Tokyo this week, where French President François Hollande used the occasion of a state visit to Japan to announce that the Eurozone crisis is over. So, that’s alright then. Mr Hollande developed his up-beat thesis by asserting that the recent unpleasantness will result in long-term benefits, as it has led to banking union, as well as better economic governance and better intra-government coordination. At which point less ebullient observers might be forgiven for sounding a cautionary note – that it may lead to these desirable things but hasn’t conclusively done so, at least not yet. The worst (if you take a very optimistic view) could be over, but basic disagreements … [Read more...] about Tales for Tapas: Japanese lessons

Italy

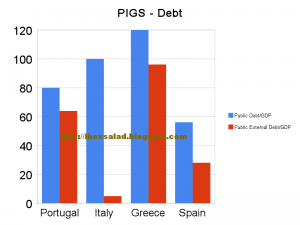

What now for the “PIGS”?

Spanish savings bank La Caixa recently brought to market a €1-billion issue of three-year cédulas territoriales at 70 basis points over similar sovereign debt. As for the investors – 49 percent of these securities backed by loans to Spanish public administrations were picked up by German or British parties and 36 percent by locals. Given the horrific recent treatment of Greek debt, this benign event probably invites a closer look at the tenets behind the classification of a nation as one of the “PIGS” - as if the mere fact that Spanish sovereign 10-years are yielding approximately the same as when the crisis broke last December, whilst the Italian equivalent pays investors 10 basis points … [Read more...] about What now for the “PIGS”?