Measured from the close of May 7 - the day Bankia’s president Rodrigo Rato announced his resignation - through noon of Thursday the 18, when its shares hit a low of €1.17, Bankia shed no less than 48 percent of its value. Adding to this the 40 percent lost since the July 2011 initial public offering through early May (this perfectly in line with the average euro zone bank over the period, by the way) and the hoards of retail depositors cajoled into parting with their savings in order to subscribe to the IPO by their local bank managers, we’re looking at just shy of a 70-point loss in a bit over eight months. It wasn’t intended to turn out that way. When Banco Financiero y de Ahorros (BFA) … [Read more...] about Bankia: A tale of confusion, conflict and unnecessary haggling

All too predictable

Under the Greece-evoking headline, ‘Hidden’ debt raises Spain bond fears, Financial Times Madrid correspondent Victor Mallet proceeded to outline the hypothesis of Spanish Cato Institute fellow (and vocal political activist, if it need be said given the company he keeps), Lorenzo Bernaldo de Quirós, that the probable overturning of many regional and local governments in the upcoming vote would result in 26.4 billion euros of concealed debt – specifically attributable to the myriad government-owned corporations conjured into existence for a variety of motives - being brought out into the open. Ignoring for the moment how Mr. Bernaldo de Quirós might have come up with so specific a figure … [Read more...] about All too predictable

Spain’s sovereign debt crisis: Round 2

It may look like a replay of last May and June, soaring bond yields and all, but there are some important differences between the current bout of financial market distemper and that of the spring. At face value, it is somewhat worse. The interest rate demanded of the Spanish 10-year bond is about 20 points higher than it was at its most back then, and the risk premium embodied in the difference between the yield on the German bund and the former is 40 basis points greater – in fact at a euro-era maximum. But looking a bit beyond the immediate it is interesting to note that all this activity has not cut into euro exchange rates remotely as much as it did in the spring, that the price of … [Read more...] about Spain’s sovereign debt crisis: Round 2

The strikers who have nothing to protest

There have been a number of signs over the last few months that the general strike called by Spain's two main trade union confederations, UGT and Comisiones Obreras (CCOO), against government economic policy and labour reform is not going to attract as big a crowd as anticipated. The first was that they switched the date of the strike from June to September 29th. The second was when, in late spring, the functionary-specific unions that had invited the leaders of UGT and CCOO, Cándido Méndez and Ignacio Fernández Toxo respectively, to a protest against government pay cuts later declared that neither would be welcome at future demonstrations. UGT and CCOO, it was felt, had attempted to hijack … [Read more...] about The strikers who have nothing to protest

Spain’s cajas bank on reform

Topping off a couple of months of frenetic activity intended to guarantee the future of the Spanish cajas de ahorros were three events at the end of July. Their chronological order is important: 1) July 21 - the approval by Congress of the LORCA, the new legislation governing the cajas which includes mechanisms allowing these savings banks to sell equity shares in themselves. 2) July 23 - the announcement on the part of Banca Cívica (the fruit of a partial merger of Caja Navarra, CajaCanarias and Caja de Burgos) that they would be availing themselves of this opportunity by signing a letter of intent with the very large and high profile American investment fund, JC Flowers & Co. The … [Read more...] about Spain’s cajas bank on reform

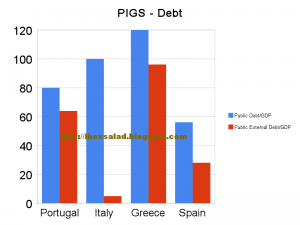

What now for the “PIGS”?

Spanish savings bank La Caixa recently brought to market a €1-billion issue of three-year cédulas territoriales at 70 basis points over similar sovereign debt. As for the investors – 49 percent of these securities backed by loans to Spanish public administrations were picked up by German or British parties and 36 percent by locals. Given the horrific recent treatment of Greek debt, this benign event probably invites a closer look at the tenets behind the classification of a nation as one of the “PIGS” - as if the mere fact that Spanish sovereign 10-years are yielding approximately the same as when the crisis broke last December, whilst the Italian equivalent pays investors 10 basis points … [Read more...] about What now for the “PIGS”?