The European Union’s three victims-so-far of the global financial meltdown have, not incorrectly, been described as the economic bloc’s periphery. Their economies are relatively small and, though at times worries about their debts have undermined the euro currency, their problems – even taken in combination – are hardly likely to bring the bloc to its knees. Individually, they were sick from a debilitating cocktail of similar problems: bed-ridden with debt and weak from a bad diet of profligate government spending and loan-happy banks. Nothing, it seemed, that a dose of bailout money from the EU and IMF could not cure with a trip to the emergency ward. Spain is showing similar symptoms. … [Read more...] about Spain: Too big to fail?

Greek debt crisis

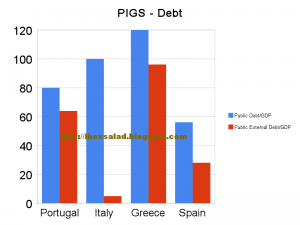

What now for the “PIGS”?

Spanish savings bank La Caixa recently brought to market a €1-billion issue of three-year cédulas territoriales at 70 basis points over similar sovereign debt. As for the investors – 49 percent of these securities backed by loans to Spanish public administrations were picked up by German or British parties and 36 percent by locals. Given the horrific recent treatment of Greek debt, this benign event probably invites a closer look at the tenets behind the classification of a nation as one of the “PIGS” - as if the mere fact that Spanish sovereign 10-years are yielding approximately the same as when the crisis broke last December, whilst the Italian equivalent pays investors 10 basis points … [Read more...] about What now for the “PIGS”?