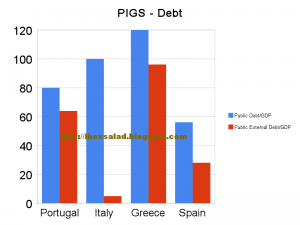

Spanish savings bank La Caixa recently brought to market a €1-billion issue of three-year cédulas territoriales at 70 basis points over similar sovereign debt. As for the investors – 49 percent of these securities backed by loans to Spanish public administrations were picked up by German or British parties and 36 percent by locals. Given the horrific recent treatment of Greek debt, this benign event probably invites a closer look at the tenets behind the classification of a nation as one of the “PIGS” - as if the mere fact that Spanish sovereign 10-years are yielding approximately the same as when the crisis broke last December, whilst the Italian equivalent pays investors 10 basis points … [Read more...] about What now for the “PIGS”?

unemployment

Running on Ẽmpty

A year after Spain’s centre-left government officially launched a massive stimulus package known as the Plan Ẽ, workers are still losing their jobs, public debt levels are scaring markets, and the economy is not likely to emerge from recession until 2011 at the earliest. Plan Ẽ, with its billions for public works projects, tax breaks and subsidies, was never intended to be more than a temporary bandage to get Spain through the worst of the fallout from the international financial crisis and the collapse of the domestic real estate and construction sector. But the wounds inflicted on Spain’s once booming economy have turned out to be slow to heal, and tearing the plaster off - as, for … [Read more...] about Running on Ẽmpty